Preventing Tax Fraud and Identity Theft

Travelers is proud to work with the finest Independent Agents

When it comes to filing taxes, there are plenty of reasons to file early instead of waiting until the last minute. The two most obvious are to get your refund back sooner, if you are receiving one, and to avoid long lines in the early-April post office rush.

One of the most compelling and more surprising reasons to file your tax return early, however, may be beating the would-be thieves to the punch.

With the sharp increase in transactions requiring the sharing of confidential data online and off, tax season is one of the most opportune times for criminals to steal personal data or capitalize on the information they have already obtained. Filing early may be your best defense.

Fraudulent tax returns are more common than you think

A criminal can use your stolen social security number or personal tax identification number to fraudulently file a tax return in your name. They cash in by having your refund re-routed to a different address or bank account.

"The sooner you file your return, the less opportunity someone else has to file a return in your name," says Tim Francis, Enterprise Cyber Lead for Travelers.

According to TIGTA, the IRS identified 58,061 fraudulent tax returns, and they estimate that there was $345.5 million claimed for these fraudulent returns.1 Unfortunately, many victims discover that their identity has been stolen only after a fraudulent claim is filed. It takes an average of 120 days for victims of tax return fraud to receive their refunds while the IRS works to resolve the issue.2

In addition to fraudulent filing, identity thieves may sell your stolen social security number and personal information to those with poor credit, criminal records or illegal immigrant status, who then use that information to apply for a job. Their employers report earnings to the IRS under your name. Then, when you file your return, the IRS comes after you for failing to report all of your income.

Criminals may also use your social security number to fraudulently apply for tax or government-funded programs, like Social Security or Medicare, in your name.

Filing early can bring the identity theft to light sooner than later, minimizing the time and damages associated with resolving the fraud.

"Remember, the cost of recovering your identity is not limited to the replacement of stolen items or money; it can also include attorney fees, lost wages, ID replacement, mail, and phone charges," Tim Francis says.

Help protect your identity when filing taxes

With the tax season in full swing, it is important to be extra vigilant about how, and with whom, you share personal information. In addition to filing early, there are other ways to help reduce your risk of becoming a victim of identity theft this tax season. If filing offline, make sure not to leave any tax forms in the car and to shred any paperwork you do not need before throwing out.

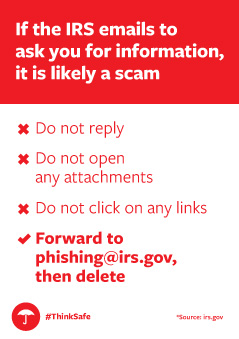

If filing online, be suspicious of email claiming to be from the IRS, even if the email has the appropriate logos. According to the IRS website, the IRS does not reach out to taxpayers for personal information unless there is an issue. Also, log off completely when finished with each transaction and be wary of slow-running computers. However you choose to file, request your refund as a direct deposit so criminals cannot have it redirected to their address or steal it from your mailbox.

Learn more ways to help protect your personal information from both online and offline risks.