Benefits of Bank Fronted Surety Bonds

Uncertain economic times, with higher interest rates and tightened credit requirements, create conditions where businesses may want to maintain more liquidity to support day-to-day operations and address unexpected events.

Bank fronted surety bonds can help companies maintain continuity of operations and avoid dipping into other funding resources such as their line of credit. These bonds allow businesses to satisfy guarantee requirements that may not be met by a traditional surety bond – in countries or jurisdictions where traditional surety bonds are not common or acceptable, for example. In addition, using bank fronted surety bonds enables businesses to diversify their capital sources and maintain financial flexibility by preserving their existing borrowing capacity.

Understanding Bank Fronted Surety Bonds

Gain an understanding of bank fronted surety bonds, a form of guarantee frequently used – and often required – in many business and regulatory situations.

(DESCRIPTION)

Travelers Logo

Text, Bank Fronted Surety Obligations.

Text, Bank Fronted Surety Obligations. Janice Bradley and Gonzalo Videla. RIMS 2022

(SPEECH)

JUSTIN SMULISON: Welcome to today's RIMS webinar sponsored by Travelers, Bank Fronted Surety Obligations. I am Justin Smulison, business content manager at RIMS, the Risk and Insurance Management Society.

A few notes before we begin. If you have a question for the presenters during today's session, please submit them by writing in the question box. Feel free to ask at any point in the presentation. We will gather them, and the panelists will reply to you directly. Following this session, the recording will be available through the on-demand events page of rims.org. And all downloads and contact information will be accessible to the sponsor.

On with today's presentation, we are here to gain an understanding of bank-fronted surety bonds, a form of guarantee frequently used and often required in many business and regulatory situations. Attendees will learn about the features of the product as well as the underwriting approach performed by most surety companies.

Our panelists will also explore some common situations when bank-fronted surety bonds are used. And speaking of our panelists, let's introduce them. Gonzalo Videla is a regional underwriting officer at Travelers with 28 years of experience in surety. In addition to his regional underwriting responsibilities, he coordinates the Centers of Excellence and leads the financial guarantee COE at Travelers.

And we've got Janice Bradley. Janice is an underwriting manager with more than 20 years of underwriting experience. She is considered a subject matter expert on financial guarantees and is excited to provide an overview of bank-fronted surety. RIMS is thrilled to welcome a large global audience. Let's begin.

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: Thank you, Justin. Good afternoon and good morning to everyone. I'm glad to be here.

(DESCRIPTION)

Text, Important note - This presentation is for general informational purposes only. Any examples or discussions of coverages or bond forms reflect those generally available in the marketplace and are not based specifically on the policies or products of Travelers. Coverage depends on the facts and circumstances involved in the claim or loss, all applicable policy or bond provisions, and any applicable law. Availability of coverage referenced in this presentation may depend on underwriting qualifications and state regulations. This presentation is not intended to be a recommendation on the suitability of a specific insurance product for your or your customer's operations.

(SPEECH)

Let's start with a disclaimer. Please take a second to read it. But as a summary, I would say that this presentation is for general information purposes.

It refers to coverages generally available in the marketplace and is not meant to be a recommendation or representation that any particular product or coverage is available or suitable to you or your company's operations.

(DESCRIPTION)

Title, Agenda. About Travelers, bank fronted surety: definition and structure, product features, bank fronted application, product advantages, examples, and underwriting and bank considerations.

(SPEECH)

Let's go over our agenda for today's presentation. We are going to very briefly talk about Travelers. We will discuss what bank-fronted surety bonds are and how they work, the application of bank-fronted surety bonds, the advantages of using bank-fronted surety bonds.

We will talk about some regulatory restrictions for sureties. We will share with you some examples of bank-fronted surety bonds. And to end, we will go over some of the sureties' and banks' considerations. Janice will kick us off with the first few slides. So, Janice, please go ahead.

(DESCRIPTION)

Janice Bradley. Title, Travelers: A Bit About Us.

(SPEECH)

JANICE BRADLEY: Thank you, Gonzalo. As you can see, Travelers has been around for a long time.

(DESCRIPTION)

Text, 165 plus years of history. We have been around for more than 165 years and have earned a reputation as one of the best property casualty insurers in the industry because we take care of our customers. With over 100 years in the surety business, Travelers is one of the largest surety writers in the world.

(SPEECH)

And with over 100 years in the surety business and as one of the largest surety writers in the world, we have the expertise to support all of your bonding needs.

(DESCRIPTION)

Corporate Profile. The Travelers Companies Incorporated (NTSE: TRV) is a leading provider of property casualty insurance for auto, home, and business. The company's diverse business lines offer its global customers a wide range of coverage sold primarily through independent agents and brokers. A component of the Dow Jones Industrial Average, Travelers has approximately 30,000 employees and operation in the United States and selected international markets. The company generated revenues of approximately $35 billion in 2021.

(SPEECH)

We have approximately 30,000 employees across the US, Canada, the UK, and Ireland. And we are the only property and casualty company in the Dow Jones Industrial Average.

(DESCRIPTION)

Title, Bank Fronted Surety (BFS)/Back-to-Back/Indemnity Backed.

(SPEECH)

What is a bank-fronted surety bond or what is sometimes referred to as a back-to-back or an indemnity-backed letter of credit? It's a surety structure that includes an additional party, that party being a bank. Essentially, both structures are the same.

Let's start with the traditional surety structure. From the illustration, you have the principle, the entity that is required to obtain the bond to ensure the faithful performance, the surety, the entity that provides the financial guarantee effectively standing in the place of the principal, and the obligee, the entity that requires the bond from the principal.

Effectively, a bank-fronted surety bond is like a traditional bond. Again, except for the addition of a bank, the surety continues to be protected by the indemnity agreement executed by the customer and issues a counter-guarantee or bond to the bank, which in turn issues a letter of credit to the obligee. This is reflected in the second illustration.

The counter-guarantee or reimbursement agreement that is issued to the bank establishes the terms and conditions of the letter of credit as well as the surety's responsibilities and repayment obligations to the bank in the event of a claim.

The obligee or beneficiary of the letter of credit typically would not have any knowledge that the insurance carrier is supporting the letter of credit behind the scenes. So it's a seamless situation as far as the customer is concerned.

(DESCRIPTION)

Text, What obligations does it secure?

(SPEECH)

What it secures. This structure can support contract or miscellaneous obligations domestically and internationally but always within the definition of permissible business and in accordance with the applicable regulations. Gonzalo will share more regarding permissible business later in the presentation.

(DESCRIPTION)

Title, Bank Fronted Surety Product Features.

(SPEECH)

Ultimately, the instrument that is issued to the bank is a letter of credit, making the obligation an unconditional pay-on-demand guarantee.

(DESCRIPTION)

Text, One year duration with automatic annual renewals, or if multiyear or no expiry date, may include pay and walk language.

(SPEECH)

The duration of the obligation is one year with automatic and annual renewals. Those evergreen clauses would now come into play.

The language contained in the letter of credit has to be approved and agreed upon by the bank. And if there is no expiry date, the letter of credit may contain what is referred to as pay-and-walk-away language.

A non-renewal of the bond will typically trigger a claim or a draw on the letter of credit.

(DESCRIPTION)

Draw down triggered by non-renewal/non-replacement of guarantee. Draw downs for maximum amount are likely.

(SPEECH)

And if the bank does draw on the letter of credit, it would most likely be for the maximum penal sum. OK. Just bear with me here.

(DESCRIPTION)

Title, When BFS can be utilized.

(SPEECH)

Bank-fronted surety is a suitable alternative when there's an appetite to support a permissible obligation. And it can be used to complement a surety bond in fulfillment of a collateral requirement. Examples of when a bank-fronted surety structure may be applicable is when an obligee will not accept a surety bond or an obligee may limit the amount of collateral they will accept in the form of a surety bond.

Please note that these restrictions are unlikely to apply with a bank-fronted surety bond given the obligee is receiving a letter of credit, allowing the bank-fronted bond to target up to 100% of the collateral amount.

Another example would be if the insurance carrier is not licensed to issue a bond in a certain country and non-admitted issuance isn't permitted or when there is not an established fronting partner in the country where the risk is located. These are just some additional things to consider when thinking about opportunities for utilization of this structure.

(DESCRIPTION)

Advantages of BFS. Customer and the Broker.

(SPEECH)

The reason this solution has become so popular is due to the benefits it provides.

(DESCRIPTION)

Text, Liquidity/credit facility capacity.

(SPEECH)

Starting with the benefits to the customer, it offers the customer more financial flexibility by providing an opportunity to increase liquidity sources or to save money, which is critical in this current economic climate.

It may help the customer's economics to switch from using their bank facility.

(DESCRIPTION)

Typically unsecured credit.

(SPEECH)

And some letters of credit may be part of a secured bank facility. And this would typically be done on an unsecured basis.

(DESCRIPTION)

Competitive pricing.

(SPEECH)

There may be a cost savings in premiums and fees instead of going directly to the bank for a letter of credit.

(DESCRIPTION)

Leverage surety capacity.

(SPEECH)

It removes the limitations of the amount of the surety bond as a percent of collateral leveraging surety capacity.

(DESCRIPTION)

Streamlined process - especially in foreign jurisdictions.

(SPEECH)

And it also is a streamlined process, making it easier to obtain guarantees since the surety coordinates the letter of credit execution. So the customer doesn't have to spend time searching for banks, especially if the requirement is for a local bank in a foreign jurisdiction.

(DESCRIPTION)

Text, Broker. Innovative solution to offer clients.

(SPEECH)

The benefits to the agent or broker is, when other security options are not available or accepted, it provides another solution. It satisfies guarantee requirements in countries or jurisdictions where surety bonds are not available. When the obligee limits the amount it would accept in the form of a surety bond, it would allow for higher limits.

It helps to solidify and insulate the customer-broker relationship or customer-agent relationship by providing varied options to satisfy their collateral needs. It also provides a new revenue stream. I'll now pass things over to Gonzalo, and he will provide additional insight into permissible obligations.

GONZALO VIDELA: Thank you, Janice.

(DESCRIPTION)

Title, Financial Guaranty Restrictions.

(SPEECH)

Let's talk briefly about some regulatory restrictions that sureties like us are subject to. Some jurisdictions have passed laws and regulations limiting the surety's ability to support financial guarantees.

In the US, New York, California, Connecticut, and Florida have lost relative to financial guarantees.

(DESCRIPTION)

Text, Internationally, there are other applicable laws, regulations, and considerations.

(SPEECH)

Violation of these restrictions can result in fines or penalties and even the revocation of a carrier's insurance license.

New York has one of the most restrictive laws about financial guarantees. Under New York law, an insurer that is not a monoline financial guarantee insurer is generally prohibited from writing obligations that fall under the definition of financial guarantee insurance anywhere in the world. This is what's known as the Appleton rule.

Permissible business includes obligations defined as fidelity and surety insurance under New York law. More specifically, the law includes as permissible surety business insurance program bonds with a duration of five years or less guaranteeing the payment of premium, deductibles, and self-insured retentions to an insurer on a worker's compensation or liability policy.

With some conditions, New York law also permits supporting lease bonds not exceeding five years in duration for non-residential lease obligations. Internationally, financial guarantees are defined differently in different countries. But generally, these definitions are narrower than the definition under New York law. So sureties that are licensed in New York typically look at New York law as the bar for compliance purposes.

So why is this relevant for this presentation? Well, the reason is that as part of the underwriting process of a bank-fronted surety bond, sureties must review the underlying obligations to confirm they fall under the definition of permissible surety business under the applicable laws and regulations.

(DESCRIPTION)

Title, Examples of BFS.

(SPEECH)

So let's go over some examples of application of bank-fronted surety bonds that we have seen in the market. These are the most common examples, but it's important to note that there may be other applications not mentioned here.

In the US, the most common application has been on insurance program bonds, bonds on deductible, and paid loss retro or loss-sensitive property and casualty insurance programs. Insurance carriers typically require collateral to guarantee the payment of premium deductibles on self-insured retentions in these programs.

The amount of collateral that can be posted in the form of a surety bond is usually limited to 30% to 40% of the total collateral amount. The difference is required in a form of a letter of credit. So bank-fronted surety bonds are an option to satisfy the letter of credit requirement under these insurance programs.

Internationally, we have seen inquiries and requests on service contracts, lease agreements, right of way, money safeguarding, admiralty, and reclamation bonds when the obligee does not accept a bond or in countries where bonds are not common or not available.

You're probably familiar with several of these obligations, but let me cover a couple of them that maybe are less familiar to you. A money safeguarding bond or guarantee is required by the regulations when an entity is collecting money for the benefit of others.

A typical example would be a company that offers a payment app. The bond or guarantee protects monies they're holding for the benefit of others in case of a bankruptcy. These bonds are usually required by regulators in Europe and Asia.

Admiralty bonds may be required following a collision or accident involving a vessel. The bond or guarantee is posted to release a vessel or other property and to secure the third party's legal claim against the vessel. In essence, admiralty bonds are similar to court bonds but filed in a Maritime court or concerning Maritime law.

Surety bonds are generally very common and available in the Americas and to some extent in parts of Europe. However, bank guarantees are more prevalent in Europe, in the Middle East, and Asia. So the bank-fronted surety bond opportunities that we have seen so far have been mostly in these regions.

(DESCRIPTION)

Underwriting Considerations. Financial Review, Operational Review, and Compliance Review.

(SPEECH)

So let's talk about what sureties typically look for. The surety's underwriting considerations for bank-fronted surety bonds focus on the same areas as with other high-risk surety obligations. Sureties look for a solid financial position and strong capital structure, good quality and stable profits.

Given the nature of these transactions, there is a special focus on a company's liquidity and cash flow generation capacity.

(DESCRIPTION)

Text, Moody's,S and P credit rating.

(SPEECH)

Generally, the target market for these transactions are investment grade type companies with high speculative grade ratings consider on a case-by-case basis.

From an operational standpoint, sureties focus on stable industries not subject to high volatility or cyclicality, a company's size, scope, and position in the market, the quality of its management's experience and track record, as well as the company's track record and reputation.

(DESCRIPTION)

Risk mitigation, transparency and information flow (public and private companies), balanced surety program.

(SPEECH)

Other important considerations include transparency, information flow, access to information and to management. Also, as a surety, we're interested in maintaining a surety program with a healthy balance of high-risk and lower-risk obligations. One last but very important item, as we mentioned in prior slides, is the compliance review of the underlying obligation from the standpoint of applicable laws and regulations.

(DESCRIPTION)

Title, Bank Underwriting Considerations.

(SPEECH)

From the bank's perspective, the bank assesses the surety company's financial position and credit rating since the surety is the bank's counterparty. The bank extends capacity and offers terms and conditions based on their assessment of the surety.

(DESCRIPTION)

Text, Surety client is the Applicant on the letters of credit/bank guarantees,

(SPEECH)

And the surety and the bank enter into a reimbursement agreement and/or a counter-guarantee or bond to guarantee the surety's obligation to the bank.

(DESCRIPTION)

Bank must be comfortable with the underlying obligation and agree with the required letter of credit wording.

(SPEECH)

The bank also reviews and assesses the underlying obligation and approves the required letter of credit wording. It is important to note that banks typically only accept unconditional wordings and prefer annual instruments with an evergreen provision.

Lastly, the bank also performs their Know Your Customer process on the surety's client who is the applicant on the letter of credit. And it follows its environmental, social, and governance policies.

(DESCRIPTION)

Title, Summary.

(SPEECH)

To end and summarizing our presentation today, bank-fronted surety bonds can help you and your client reduce the use of the bank line to secure letters of credit.

(DESCRIPTION)

Review existing collateralized agreements to determine if a bank fronted surety bond can be used, focus on Insurance Program and collateral posted to guarantee paid loss retro and deductible programs. Consider Bank Fronted Surety bonds for international guarantees in countries where surety is not typically accepted.

(SPEECH)

So if you have collateralized agreements or a loss-sensitive insurance program or are required to post guarantees in foreign countries where traditional surety bonds are not available or accepted, there may be an opportunity for you to use bank-fronted surety bonds as an option.

If you have needs like this, contact your surety broker or your surety underwriter to learn more about bank-fronted surety bonds. Thank you. Justin, I turn it back to you for the Q&A portion of the presentation.

(DESCRIPTION)

Text, Questions and Answers.

(SPEECH)

JUSTIN SMULISON: All right. Well, we've got some questions. And everybody can hear me, right?

GONZALO VIDELA: Yes, I can. Yes.

JUSTIN SMULISON: OK. Great. All right. Here we go. So what are we seeing as the best opportunities in the bank-fronted space?

GONZALO VIDELA: Thank you. That's a good question. As indicated in my remarks, in the US, the majority of the transactions that we have seen are related to insurance programs. We have seen the most success in the lower range of the investment grade and high range of the spec grade ratings.

So from double B, double B plus to triple B, triple B plus is where we've seen most of the success. And the reason being that it seems that that's where there is a good balance between the risk appetite that a surety may have and also being able to provide competitive pricing.

Internationally, I guess the opportunities that we have seen have been more in regions where bonds are not commonly accepted and available. So as I said in my remarks, in the Americas, bonds are transacted fairly commonly.

But as you move East and you go to Europe and especially in Southeast Asia, bank guarantees are more common. So the majority of the opportunities we've seen have been mainly in Southeast Asia.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: OK. Great. I've got another one. What is the most important thing to keep in mind when working on a bank-fronted deal?

(DESCRIPTION)

Janice Bradley.

(SPEECH)

JANICE BRADLEY: Yeah. That's a really good question. There are a few steps to consider from a customer's perspective. Bank-fronted bonds represent an opportunity to free up liquidity sources or to save money relative to the cost of their existing letter of credit facility. So understanding what the true driver is, is it freeing up availability under their credit facility, or is it pricing will help to guide that discussion with your surety market.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: OK. Gonzalo, would you say that you agree there?

GONZALO VIDELA: I do agree with that.

JUSTIN SMULISON: OK. Great. Can a bank-fronted surety bond be issued along with a surety bond, or do they compete or replace one another?

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: Janice, do you want to take this or you want me to?

JANICE BRADLEY: You can go ahead.

GONZALO VIDELA: OK. So that's another good question. The short answer is yes. Especially in the case of insurance programs, as we mentioned, of the total collateral amount required by the insurance carrier, there's a portion that can be satisfied and posted with a surety bond. And then the difference is a letter of credit.

So particularly in those situations, we have seen with frequency that a surety bond is written for, say, 25%, 30% of the collateral required and the other 75 or 70% is satisfied with a bank-fronted surety bond. So we've seen several of those situations. So it's common.

JUSTIN SMULISON: Fantastic. I didn't cut anybody off there, did I?

GONZALO VIDELA: Nope.

JUSTIN SMULISON: Nope? OK.

JANICE BRADLEY: No.

JUSTIN SMULISON: Would bank-fronted surety bonds be accessible to building developers who currently need LOCs as securities in development agreements with municipalities, or is the product more for larger corporations?

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: Another great question. What we have seen so far has been mainly driven by larger corporations but not exclusively. As I mentioned in some of the slides, there are certain things that sureties would look for in terms of the quality of the credit, the quality of the information received, the frequency and access to information, the transparency.

So all those factors would be taken into account. So I wouldn't say that it's not available to developers. But I'd say we would look at good, solid credits where we have good access to information and access to management to get comfortable with these type of structures.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: All right. I got another question from the audience for you. What if the banking facility in use by the client does not have international capabilities?

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: Can you repeat that question, Justin?

JUSTIN SMULISON: Sure. What if the banking facility in use by the client or the client's bank does not have international capabilities?

GONZALO VIDELA: So in those situations, I think bank-fronted surety bonds are especially helpful in those situations. And the reason I say that is the bank facility that is used is the surety's banking relationship.

So if the surety's banking relationship has presence in that particular country or foreign jurisdiction, then the client doesn't have to try to find a bank who has a local presence in that country.

So it's specifically for those reasons is that we mention that the process itself is streamlined for the client because they don't have to deal with trying to put in place those facilities with a foreign bank. The sureties may have relationships with global banks that have presence in a particular country where the letter of credit is needed.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: OK Yeah, we're getting a lot of great questions from the audience. We're just sifting through it. I've got another good one for you. Are there any references to the surety carrier on the Letter of Credit, or LOC? Or is it totally clean and only references the bank issuing the LOC?

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: Janice, you want to--

JANICE BRADLEY: Sure. So it would be totally clean. It would just be between the client and the bank. The counter-guarantee is between the insurance company and the bank. So the letter of credit would be clean as far as the customer was concerned.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: OK. And on that same topic, does the surety carrier select the bank that issues the LOC?

(DESCRIPTION)

Janice Bradley.

(SPEECH)

JANICE BRADLEY: So the relationship between the bank and the insurance company, it's a relationship that they have between themselves. So, yes, the surety is selecting the banks that we're working with. We work with several banks.

JUSTIN SMULISON: OK. Great. We got some more coming in here. Just bear with us for just a moment as we get some new ones. Folks, let me just remind you. You can put your questions in the Q&A box, and we're going to try to get to as many as we can. OK. So does Travelers have existing banking relationships to use when dealing with these sorts of scenarios?

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: Yes, we do. We, in fact, have several banks that we have relationship with. And no different than maybe sureties, banks have different footprints. They have different appetites. They have different, I guess, strengths in what they can do.

So we do have a full suite of banks. And depending on the type of obligation, depending on where the letter of credit is needed, we choose to use one bank or another. So, yes, we do have several relationships currently.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: Excellent. And we're just sifting through some more. Is it usually a harmonious relationship?

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: I guess it refers to the surety between the surety and the bank. So if that's the question, the answer is yes. We do have very good, very close relationships with the banks. So knock on wood. But so far, it's been a great, great relationship.

JUSTIN SMULISON: OK. Do you see this product trickling down to the middle market for clients with strong balance sheets but who also may have smaller letter of credit outlays?

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: Janice, you want me to take this or--

JANICE BRADLEY: Sure. You can take that.

GONZALO VIDELA: OK. So the answer is yes. From our standpoint, there are a few things that we look at. And I'm sort of repeating myself, but for us, it's very important to be comfortable with the particular credits, so the particular client, and access to information, access to management, all those things that we mentioned during the presentation.

So as long as we can check that box sort of speak, then the product can be available to middle market accounts. So I think that, for us, is the most important thing.

The other thing that I wanted to mention was, it's important for us to keep a balance in the surety program. And I mentioned that too we want to have a balance between higher-risk obligations like these ones and lower-risk obligations.

So I think in the way the question was asked, the fact that it may be a smaller need doesn't necessarily mean that we wouldn't have an interest. The only exception to that is, if the need is too small, maybe there's no appetite for it simply because when you look at the structure of these products, there are a lot of people involved, a lot of entities, and a lot of coordination, a lot of documentation that goes behind the scenes.

So there's got to be a trade-off between the effort and the benefit, if you will, of putting one of these together. So if it's too small, probably not. But if it's a smaller size, it can be considered.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: OK. Got another one. Two-part question for you. What would happen if the bank decided to non-renew per the evergreen provisions? Would this cause a default?

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: Yes. The short answer is yes. If the bank does not renew the letter of credit and the letter of credit is not replaced just like any other letter of credit, the beneficiary would claim on that letter of credit. They would claim on the surety's counter-guarantee. And the surety will seek to get reimbursed from the client.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: OK. Going through some more here. Give us a moment, folks. Keep putting your questions in the box here, folks. You're doing great. We're having a really great dialogue here. You're getting direct insight from two leaders in this space.

Let's see what's coming in next that we can take. Oh, OK. Is it OK for me to ask questions about particular countries?

GONZALO VIDELA: Sure.

JUSTIN SMULISON: What is the best process to get overview information for a particular country? Let's just start with that.

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: That's a good question. It's kind of broad. And I'm not sure what context was used to ask the question because the overview would be on the country itself, the country's economy, or something to that effect. I'm not sure how to answer the question. So whomever asked that question, if they could clarify.

JUSTIN SMULISON: OK. All right. So the follow-up to that was, what is reasonable and customary in Singapore, for example, as opposed to Western Europe or the United States?

GONZALO VIDELA: So Singapore traditionally has been more of a bank guarantee market. There are a few surety bonds that have been written there. But usually, they look and behave very similar to a bank guarantee or a letter of credit. So if that's the question, in Singapore, bank-fronted surety bonds would be applicable from that standpoint.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: I think I found another good one. I'm just waiting to get a thumbs-up. Nope. Give that another moment. Keep putting your questions in the box, folks. We are getting to as many as we can. Gonzalo, if you don't mind, while we're waiting for the next question, tell us a little bit about the Centers of Excellence that you lead.

GONZALO VIDELA: So Travelers has 15 teams that focused on particular market niches or industries or particular surety products. These teams are comprised of underwriters, both in our field office structure and home office.

We have claims people. We have legal support. And the team is basically focused on understanding the particular niche or product, developing an underwriting strategy around it, and educating the rest of the organization around that product or niche.

We started with that several years ago. And we started with one or two teams. And we're up to 15 now. And we have over 100 people involved in different teams. So it's something that works very, very well for us and provides us a platform to learn and educate our underwriting teams on particular products or niches as I mentioned, industries as I mentioned.

JUSTIN SMULISON: OK. Excellent. 15 centers?

GONZALO VIDELA: 15. 1-5. Yeah.

JUSTIN SMULISON: Wow. OK. That's pretty big achievement. Is there any success with this product using a domestic bank or foreign only? This is the first of a multi-part question.

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: So we do have relationship with both. We do have relationships with some foreign banks. But we also have relationships with local banks that are based primarily out of New York. So, yes, both.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: OK. And then I'm going to do the follow-up there. The participant is curious on a discussion of the risk. If a bank decides, overall, that this bank-fronted surety business is no longer a business they want to be in and gets, I guess, rid of all LOCs with counter-guarantees, is that-- I'll re-ask that question.

GONZALO VIDELA: Thank you.

JUSTIN SMULISON: Have you ever been in a situation where a bank decides that the bank-fronted surety bond business is no longer a business they want to be in and then gets rid of all LOCs with counter-guarantees?

GONZALO VIDELA: No, we have not been in that situation. And I think that would be a very, very difficult thing to do for a bank, at least the ones that we work with.

JUSTIN SMULISON: OK. And what is the largest percentage of an LOC that can be replaced with a surety bond?

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: So I think the question refers to a bank-fronted surety bond. So if that's the case, then the answer would be up to 100% of that letter of credit depending on the surety's appetite and depending on who the client is and capacity needed, et cetera. But it can be up to 100%.

JUSTIN SMULISON: Wow. OK. And how does a surety-backed LOC provide a cost advantage over an ILOC under the client's credit facility?

GONZALO VIDELA: So we're not representing or saying that it does in every single case, but we have seen situations where it does. And the reason for that is that there is a surety involved that is guaranteeing the bank.

And as long as the bank is comfortable with that surety and their financial position, credit rating, and the underlying documentation between the two, it is possible that the surety gets a better pricing than decline going direct to their bank.

JUSTIN SMULISON: OK. And with a bank-fronted surety, what is the level of exposure and risk to the bank?

GONZALO VIDELA: What is the level-- can you repeat that, Justin? Sorry.

JUSTIN SMULISON: Sure. With a bank-fronted surety, what is the level of exposure and risk to the bank?

(DESCRIPTION)

Gonzalo Videla.

(SPEECH)

GONZALO VIDELA: I think it's the same. So from a client's perspective, the exposure and the risk would be the same as the client going directly to their bank and getting a letter of credit directly from the bank because the underlying obligation and the amount presumably are the same. So the exposure and the risk would be the same.

(DESCRIPTION)

Justin Smulison.

(SPEECH)

JUSTIN SMULISON: All right. We're going through some more here. Just give us a moment, folks. Keep putting those questions in the question box. And we will get to it. Janice, you're a subject matter expert on financial guarantees. Do you ever do guest columns and publications and things like that?

JANICE BRADLEY: No, I have never done that.

JUSTIN SMULISON: No? Oh, OK. I was hoping that you were going to say, well, yes, I used to do that all the time. OK. When you joined as an underwriter, was that something you had always wanted to do or you sort of fell into it?

JANICE BRADLEY: Surety underwriting is relatively new to me. I've been doing it for just about almost 10 years now. But I also have underwriting experience on the P&C and group life side of the house. So, yeah.

JUSTIN SMULISON: Excellent. OK. All right. I think we're just making sure that some of the questions are up to snuff here. So keep putting your questions in there, folks. And we're going to get to as many more as we can.

Just a reminder that there will be a copy of this video on the on-demand events page of rims.org very soon. The on-demand events page also has other webinars that we've done.

You'll also find a previous Travelers session there from this year. It's called Your Greatest Asset, Smart Risk Management in the Age of Workforce Transformation. That was held on June 28th. That was a great one. So you will see that there. You're in good company.

Let's see if we've got anything else that we can use here. Or maybe I'll wait for the boss to tell me if it's time to pick it up. All right. I think we're going to get ready to close out for now. So I would like to thank Gonzalo Videla and Janice Bradley from Travelers for their time and expertise.

Today's session will be available on the on-demand events page of rims.org very soon. So look for that probably by Monday. Remember, we have all your questions, and we will gather them. Panelists will reply to you directly if we didn't get a chance to get to them today.

Be sure to check out RIMSCast. That is the society's official free and weekly podcast that is hosted by yours truly. Visit rims.org/rimscast to hear all 206 episodes. The RIMS ERM Conference 2022 will be held live and in person in Indianapolis on November 11th and 12th. We want to see you there. So view the agenda. Register at rims.org/erm2022.

And new registrations will receive an additional discount by typing the code RIMSCast 2022 in the payment page before checkout. Finally, RIMS is global, and we'd love for you to build your network with us. Visit rims.org/membership and apply. Thank you, all. This was a great session. Stay safe.

(DESCRIPTION)

Travelers Logo

Produced in partnership with RIMS. Travelers Casualty and Surety Company of America and its property casualty affiliates. One Tower Square, Hartford, Connecticut 06183.

This material does not amend or otherwise affect the provision or coverages of any insurance policy or bond issued by Travelers. it is not a representation that coverage does or does not exist for any particular claim or loss under any such policy or bond. Coverage depends on the facts and circumstances involved in the claim or loss, all applicable policy or bond provisions, and any applicable law.

Availability of coverages referenced in this document may depend on underwriting qualifications and state regulations.

Copyright 2022 Travelers Indemnity Company. All rights reserved. Travelers and Travelers umbrella logo are registered trademarks of The Travelers Indemnity Company in the U.S. and other countries.

How does a bank fronted surety bond differ from a traditional surety bond?

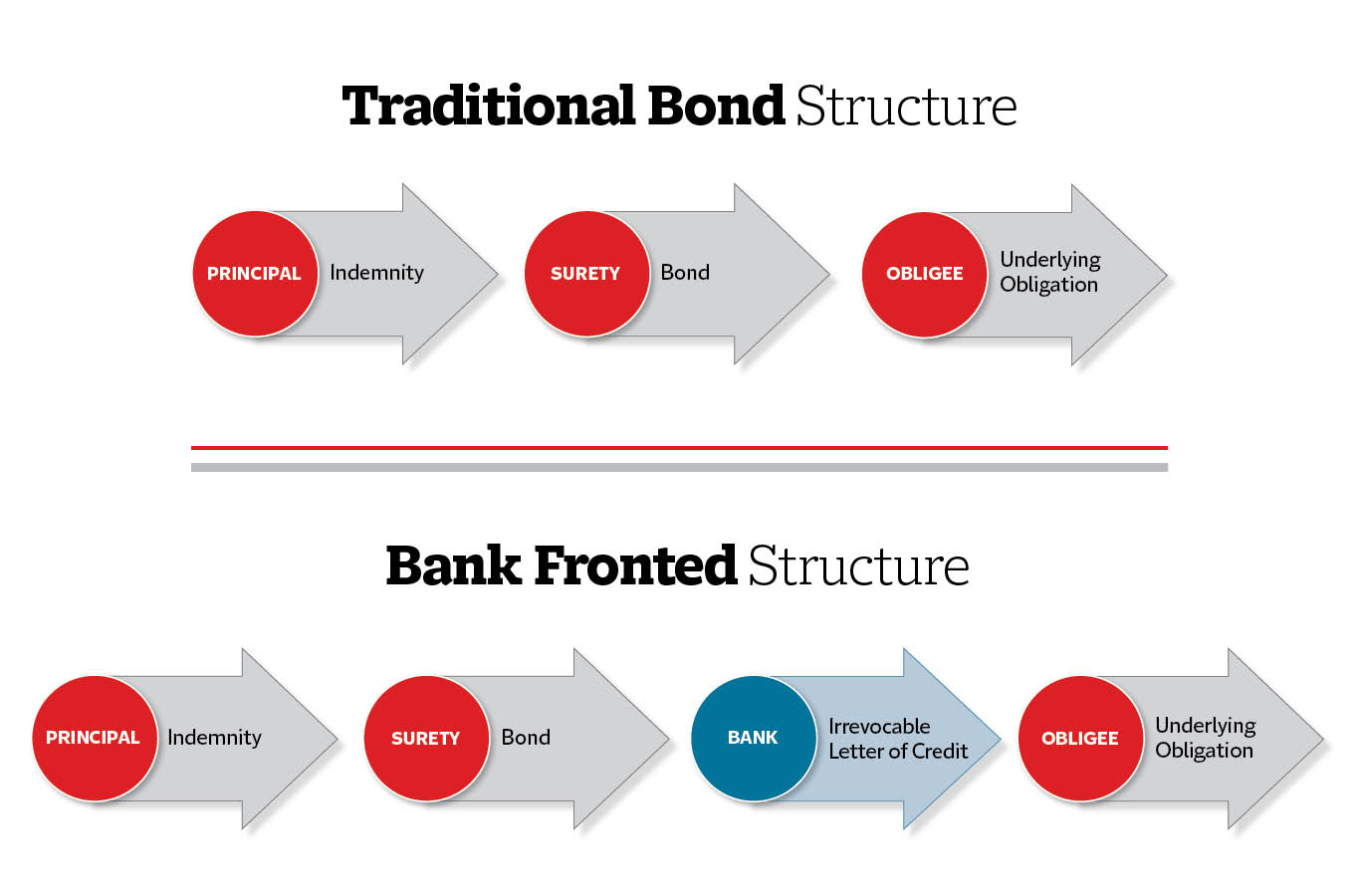

A traditional surety arrangement involves an agreement among three parties whereby a third-party entity (the surety) stands behind a company (the principal) and provides a guarantee to the other party (the obligee) that the principal will fulfill an obligation. If the principal fails to fulfill this obligation, the surety will complete the obligation or compensate the obligee for the financial loss.

A bank fronted surety bond includes a fourth party: the bank. With a bank fronted surety bond, a surety uses its financial position and relationship with a bank to procure a letter of credit on behalf of its client (the principal). In a bank fronted structure, if the bank receives a demand under the letter of credit the bank will look to the surety for payment.

The infographic displays the difference between Traditional Bond Structure and Bank Fronted Structure. Each structure model is represented by a workflow made up of multiple circles combined with a connecting arrow, each with text inside.

Under Traditional Bond Structure, the first red circle reads Principal with an arrow that says Indemnity. The second red circle reads Surety with an arrow that says Bond. The Third red circle reads Obligee with an arrow that says Underlying Obligation.

Under the Bank Fronted Structure, the components remain the same with the addition of a blue circle and arrow between Surety and Obligee. The blue circle reads Bank with an arrow that says Irrevocable Letter of Credit.

To access a bank fronted surety bond, the principal requests the bond through their broker or agent, as they would a traditional surety bond. The surety then asks the bank to execute a letter of credit on behalf of the principal. The surety then counter-guarantees the transaction by issuing a bond to the bank.

The obligee/beneficiary (the contracting company or regulatory body) receives the letter of credit directly from the bank.

Who needs bank fronted surety bonds?

Organizations can use bank fronted surety bonds domestically and internationally. They are helpful for situations when:

- The obligee/beneficiary does not accept a standard surety bond.

- The obligee/beneficiary limits the amount it accepts in the form of a traditional surety bond and requires a letter of credit in addition to the bond.

- It is necessary to satisfy guarantee requirements in countries or jurisdictions where traditional surety bonds are unavailable.

Examples of bank fronted surety bonds:

- Insurance programs. On high deductible and loss-sensitive insurance programs, insurance carriers typically require collateral to guarantee the payment of premium, deductibles or self-insured retention by the insured. A letter of credit is usually required for at least a portion of the total collateral. A bank fronted surety can satisfy this requirement.

- Lease agreements. When companies with international subsidiaries need to rent office space, a bank fronted surety bond can help provide a guarantee for the rental cost obligations without tying up liquidity.

- Money safeguarding guarantees. For international companies that regularly collect funds on behalf of accounts, retailers and clients, a bank fronted surety bond helps protect the funds in case of bankruptcy.

Benefits of bank fronted surety bonds vs. traditional letters of credit

For organizations operating in industries and locations in which obtaining traditional surety bonds or letters of credit is more challenging, bank fronted surety bonds provide a viable alternative. Companies may find the following key benefits appealing:

- Potential cost savings. Instead of going directly to its bank for a letter of credit, the principal can leverage its surety relationship to get a bank fronted surety bond, satisfying the security requirements while potentially saving on premiums and bank fees.

- Liberated liquidity. By using a bank fronted surety bond, a business can better maintain the limits of its existing lines of credit from its lenders, helping grow its organization and improving general cash flow.

- More favorable financial ratios. A bank fronted surety bond is typically an unsecured credit that frees up collateral or guarantee requirements, which can help improve the principal’s financial position and outlook.

- Streamlined guarantee process. For businesses unfamiliar with operating internationally or in jurisdictions where traditional surety bonds aren’t accepted, a bank fronted surety bond can help make it easier to obtain guarantees. This convenience can be a big benefit, especially when a beneficiary requires a local bank in a foreign jurisdiction to issue a letter of credit.

Choose a provider with proven capabilities and international experience in bank fronted surety bonds

For specific businesses, bank fronted surety bonds provide more flexibility when posting guarantees with clients and regulators. They can help companies retain financial liquidity and capacity and potentially save on bank fees while streamlining the bonding process.

Travelers offers industry-leading bond products. In addition, Travelers has connections with a network of global banks, which makes doing business internationally more accessible for Travelers business customers.

Learn more about how Travelers helps companies large and small – from sole proprietorships to multinational conglomerates – deftly leverage surety bonds as a strategic financial tool to strengthen their broader business strategy. Then find an independent agent near you to discuss how Travelers can help you meet your business goals.