Your Deductible and Claim Payment

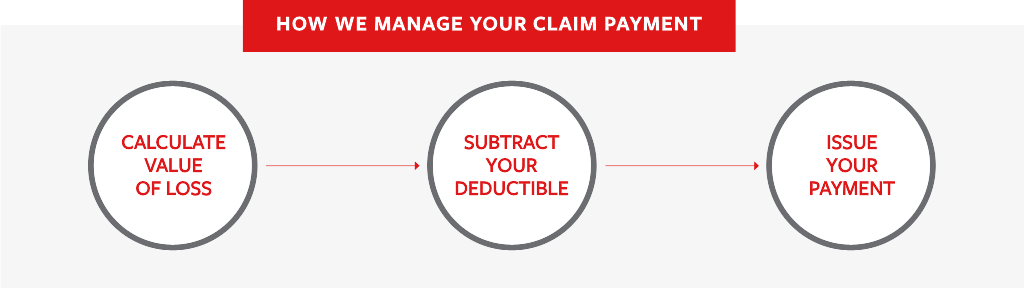

Below is a brief description to help you understand how we typically determine and issue your claim payment.

First, we calculate the value of your loss.

We assess your damages to determine the value of your loss. That value along with the provisions in your policy determines what we may pay you. For example, if you have repairable damage to your vehicle, we’ll generally write or review an estimate to help determine the amount that allows the vehicle to be repaired to its pre-loss condition. If you’ve had damage to your home, we’ll typically write or review an estimate to repair or replace your damaged property to determine the value of your loss.*

Next, we subtract your deductible.

Once the value of your loss is determined, the next factor taken into consideration is your deductible, which is the amount that you may owe in order to have your damaged or stolen item(s) repaired or replaced. Generally, when you purchase a policy, you select certain deductibles that may apply when you have a claim. As a result, that amount will be subtracted from the value of your loss.*

Last, we’ll issue your payment.

Once the value of your damage is assessed, and if we are paying you directly (often we’ll pay repair shops and contractors directly with your permission), you can either have your payment sent electronically via one of our ePay options, which allows money to be directly deposited into your bank or PayPal account, or have a check mailed to you. If you have a lienholder or lease holder for your vehicle or property, their name may be included on your check.

* Each claim is unique and the value of any damage and the deductible applied is assessed based on the individual facts of each claim.

Related articles

What Is Depreciation in Insurance Claims?

Learn how we calculate depreciation and how to submit a request for recoverable depreciation.

Claim Insurance Dictionary

Our insurance terms glossary provides simple explanations of common insurance terms.

What Is an Auto Insurance Deductible?

What is a deductible and how does it work? Here are some points to consider when evaluating car insurance options to decide what will work for your needs.

Additional resources

Find a service provider

Search for a reputable service provider to repair your car or home, or to provide medical care.

Check your claim status

Find out where you are in the claim process.

Claim guide library

A collection of materials designed to help you navigate the claim process.