4 Ways Domestic Freight Brokers Can Avoid Unexpected Liability Claims

Freight brokers pair companies that require shipping services with reliable motor truck carriers who can transport their goods. Acting as intermediaries, they bring businesses together to create opportunities for all involved: a lucrative, but complex model.

In this arrangement, freight brokers are at an increased risk of third parties claiming the broker is responsible for losing or damaging their goods. Freight brokers may not realize that they can still be held liable for damage to or loss of goods, even if they did not physically handle them. The reality is that when there is a claim related to shipment issues, it impacts all parties involved.

Here are four ways that freight brokers can protect their domestic operations from liability claims that may not be covered by traditional cargo insurance policies:

Know what you are signing.

Thoroughly review the details of any contract to ensure you haven’t agreed to be held liable as a motor truck carrier. Similarly, carefully review shipping paperwork or bills of lading to check that you haven’t been described as the motor truck carrier.

Understand your insurance policies and look for potential gaps in coverage.

Learn where you are covered and where you are not. Within many traditional cargo insurance policies, the legal liability of a freight broker isn’t explicitly defined – leaving freight brokers susceptible to hidden vulnerabilities. Choose an insurance partner that truly understands the liabilities associated with your unique operations. For example, Travelers is known for its deep risk management expertise offered by specialists in a broad range of industries and business types.

Consider your exposures beyond traditional broker liability.

Are you prepared to compensate your shipping customer when your motor truck carrier causes damage and fails to pay? Travelers offers critical endorsements that help minimize gaps and strengthens a freight broker’s insurance program. Consider our Brokers Operations Coverage that can kick in when a motor truck carrier can’t pay for a loss that they are liable for. Even though you are not liable, you may be able to compensate your shipping customer to put their mind at ease and preserve your business relationship.

Implement a carrier vetting process (and document it).

As a freight broker, you may be targeted by cargo thieves who deceive you into turning over the cargo through identity theft or fictitious pickup schemes. This can leave you on the hook for replacing the goods that have been stolen.

Implementing a carrier vetting process can help protect you from becoming the victim of a cargo theft scheme. Plus, a well-documented carrier vetting process can assist in an efficient resolution of a claim.

It’s critical for freight brokers to have a trusted insurance carrier that understands the nuances all parties bring to a claim. To learn more, browse this collection of transportation resources and discover how Travelers Inland Marine coverage can help freight brokers protect their businesses.

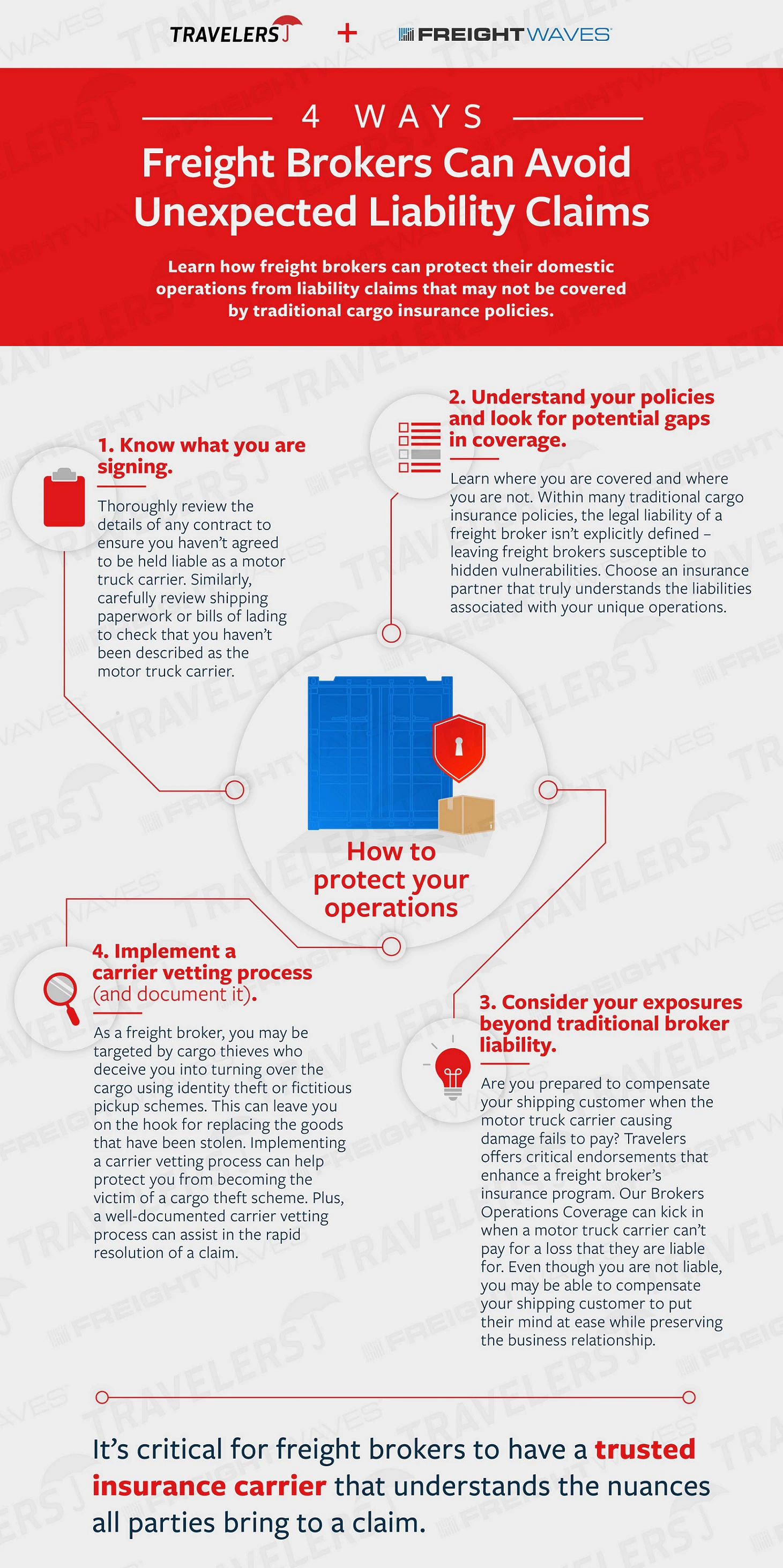

4 WAYS

Freight Brokers Can Avoid Unexpected Liability Claims

Learn how freight brokers can protect their domestic operations from liability claims that may not be covered by traditional cargo insurance policies.

How to protect your operations

- Know what you are signing.

Thoroughly review the details of any contract to ensure you haven't agreed to be held liable as a motor truck carrier. Similarly, carefully review shipping paperwork or bills of lading to check that you haven't been described as the motor truck carrier. - Understand your policies and look for potential gaps in coverage.

Learn where you are covered and where you are not. Within many traditional cargo insurance policies, the legal liability of freight broker isn't explicitly defined - leaving freight brokers susceptible to hidden vulnerabilities. Choose an insurance partner that truly understands the liabilities associated with your unique operations. - Consider your exposures beyond traditional broker liability.

Are you prepared to compensate your shipping customer when the motor truck carrier causing damage fails to pay? Travelers offers critical endorsements that enhance a freight broker's insurance program. Our Brokers Operations Coverage can kick in when a motor truck carrier can't pay for a loss that they are liable for. Even though you are not liable, you may be able to compensate your shipping customer to put their mind at ease while preserving the business relationship. - Implement a carrier vetting process (and document it).

As a freight broker, you may be targeted by cargo thieves who deceive you into turning over the cargo using identity theft or fictitious pickup schemes. This can leave you on the hook for replacing the goods that have been stolen. Implementing a carrier vetting process can help protect you from becoming the victim of a cargo theft scheme. Plus, a well-documented carrier vetting process can assist in the rapid resolution of a claim.

It's critical for freight brokers to have a trusted insurance carrier that understands the nuances all parties bring to a claim.